It’s hard to believe, but if you and your parents live at the same address, you can stay on their car insurance policy indefinitely.

However, there are some situations where staying on your parents’ auto insurance policy may no longer be allowed. Keep reading to learn about the conditions under which getting your own insurance makes sense or becomes necessary.

No age limit to how long you can be on your parents’ car insurance

Unlike health insurance — where most children can no longer be on their parents’ health insurance policy after their 26th birthday — there’s no real age-related cut-off point for car insurance. That’s as long as you stick to some pretty standard guidelines.

- You and your parents must have the same address listed on your driver’s license, and you must live there as your primary address.

- The car in question must be owned by — and registered to — your parents at that address.

- You can also be covered if you’re a full-time college student using their car.

If you meet those requirements, you can be covered by your parents’ insurance policy. However, if you move out of your parents’ home permanently, you’ll need to apply for your own car insurance policy.

Do I need insurance to drive my parents’ car?

Whether you need insurance to drive your parents’ car depends on factors like your location and their insurance policy. Generally, if you’re listed as a permitted driver on their policy, you’re likely covered. However, not being listed — or being excluded — may require you to get your own insurance to avoid legal and financial risks.

Is it required that I’m on my parents’ insurance?

No, it’s not required, but most insurance companies typically require listing all licensed household drivers on a car insurance policy, including those whose driver’s license shows the same home address.

When to apply for your own car insurance policy

Let’s look at some scenarios where you need your own insurance and when you can remain on your parents’ policy.

You co-own a vehicle with your parents but do not live at home.

Car insurance is usually linked to the location and vehicle, not the driver. If you reside with your parents and share ownership of a car registered in both your names, it can be included in your parents’ auto insurance policy.

However, if you permanently move out of your parent’s home and the vehicle you co-own is garaged at your new home, you’ll need to register it in your name and purchase your own car insurance policy. In short, your parents cannot insure a car that is not kept at their home address.

You live in your parent’s home and own a car registered in your name only.

Here, you have options. You may be able to stay on your parent’s car insurance if you own a car, but it depends on the rules of their insurance provider. Adding your vehicle to their policy could increase their premiums. However, it might still be more cost-effective than getting your own separate policy.

- A tip for you: Ask your parents’ insurance company if they have special discounts available for drivers who are moving from their parents’ policy to their own. They may offer exclusive discounts that you wouldn’t have access to otherwise.

You’ve moved out but still use your parents’ car occasionally.

If you move out but still occasionally drive your parents’ car — you know, on holiday visits or when you’re helping them do chores — you can still be covered under their policy as a “permitted driver.” However, you should not garage the car at your house as this could negate the policy.

You’re going away to college but will be back during breaks.

If you’re headed to college, most insurers understand the temporary nature of your move and will allow you to stay on your parents’ policy as a listed driver. After all, a semester away doesn’t mean you’ve permanently flown the nest.

Now, if you’re going to be using one of their cars while you’re away at college, both you and the vehicle will be allowed to stay on their policy as long as your permanent address remains at your parents’ home.

- A tip for you: If you don’t have a vehicle with you at school and you won’t be driving much, you may think getting off your parents’ insurance makes sense. However, it’s worth reconsidering! Staying on their insurance provides continuous coverage for driving their vehicles when you return home. This continuity can also lead to a more favorable rate when you eventually seek your own auto insurance.

- A tip for your parents: If your college is more than 100 miles away and you’re not using your parents’ vehicle, they may be eligible for a discount while you are away at school.

You’re returning home after having a permanent address elsewhere.

If you move back to your parents’ home and plan to use your parents’ car again, you can be relisted for coverage under their insurance. They’ll just have to inform their insurance provider of the change. Some insurers will want to see that your driver’s license is changed to reflect your new permenant address.

As stated above, If you return home and you’re now driving your own car, registered in your name, you have a choice:

- Depending on the state and insurer, you may be able to add your car to your parents’ insurance if you live with them and your car is kept at their house.

- If you decide to keep your own car insurance, you must inform the insurance provider of your new address and ask to have your parents (and other drivers in the home) listed as non-drivers of your vehicle.

You and your spouse are living in your parents’ home.

If you and your spouse live with your parents and use their car, you can both be listed on their auto insurance policy as permitted drivers. Now, if you or your spouse own your own car with the title and registration in your name, you may choose to insure the vehicle with your own car insurance policy.

Remember, all drivers who share the same permanent residence should be listed on each policy — even if they won’t be driving the car. (More on this later.)

You’re moving out of state or across the country.

Car insurance coverage is tied to vehicles and addresses, not individuals. That means that your car insurance won’t necessarily follow you if you relocate to another state. In fact, you may have to find a new insurance provider altogether, as some insurers don’t do business in all states.

Does everyone in a household need to be on a policy?

In general, everyone living under the same roof should be listed on the car insurance policy so that the insurance company can accurately calculate risk and quote the correct premium. If someone in the household who is not listed on the policy gets into an accident, the insurance company may deny the claim or cancel the policy.

Even if household members have car insurance or don’t drive at all, reputable insurance providers will ask that they be listed on a car insurance policy. This includes spouses or significant others, family members who live with you, roommates, and children who are either approaching driving age (14 years or older), learning to drive, or are already drivers.

Some families may want to list a nanny, home health nurse, or housekeeper who is caring for a family member, even if they don’t live in the home full time, as there may be times when they will need to use the car. If this sounds like your situation, speak with your insurer to see where they stand on definitions of permitted or listed drivers.

Just an FYI: the reverse is also true. Just as your parents can include you as a permitted driver, they can also list you as an “excluded driver.” This means that they acknowledge you are living under their roof but are NOT insuring you on their policy. Some insurance companies will allow excluded drivers to be associated with individual vehicles, so a household member may be permitted to drive the SUV but not the classic 1960s-era Mustang. Sorry!

Switching from your parents’ coverage to your own car insurance

In general, when you move out of your parents’ home and into your own place, you’ll need to get separate insurance for your car. Even if you co-own a vehicle with your parents, their insurance won’t cover you if you don’t live under their roof.

Moving to your own car insurance policy might feel a little scary, but with some outside help, you can find the right coverage that fits your needs and budget. Read more about car insurance and how it works.

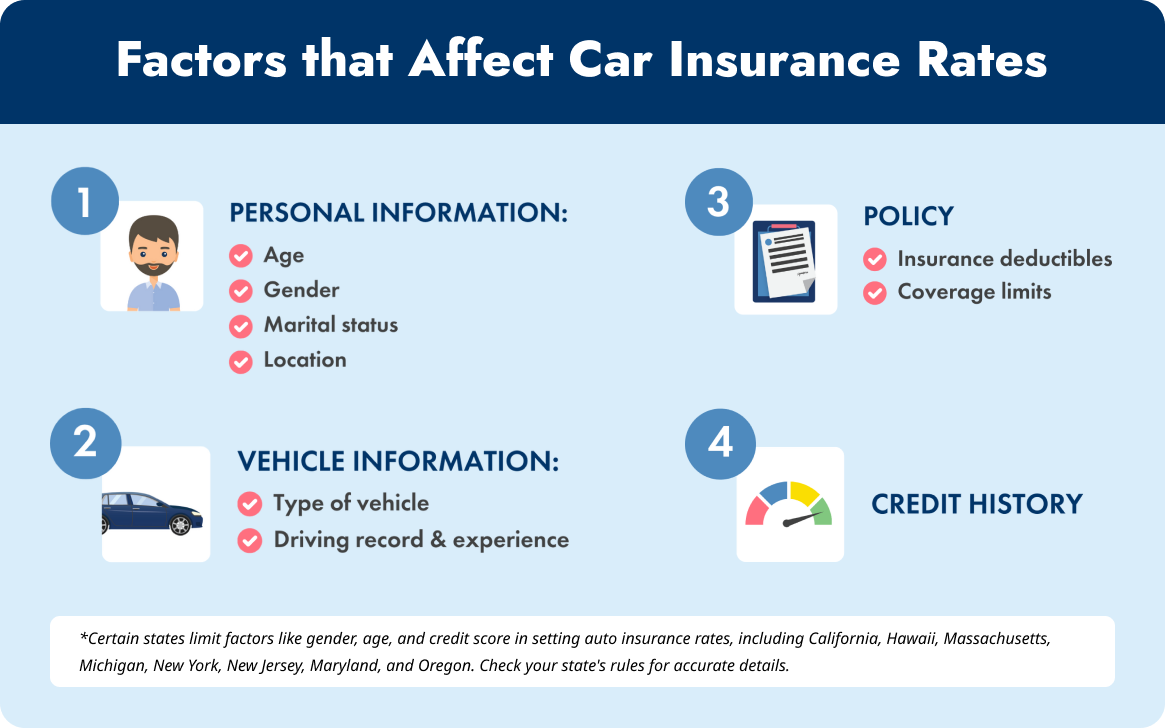

The first thing you’ll need to do is get a quote. Several factors influence how much you’ll pay for car insurance. Insurers look at an array of factors when determining how much they’re going to ask you to pay for car insurance.

They will assess your risk level based on your driving record, insurance history, age, gender, and location. They also consider the age, make, and model of your car when determining your insurance premiums.

Sometimes, they look at credit history. For instance, drivers with accidents or violations pay more, as do those under 25 or with poor credit, who also face higher premiums. However, some states prohibit credit history from being used to set rates — which is good as younger drivers may not have had much experience building up a credit rating yet.

Here are 3 steps to help you start to think through the process:

- Figure Out Your Needs: Think about how you drive, what your car is worth, and what you can afford to pay every month. Also, think about how much you’ll be able to afford for a deductible in case you have to make a claim. Read more on deductibles.

- Bundle Up: If you have renters or homeowner’s insurance, you might save money by getting your car insurance from the same company. Read more on bundling policies.

- Shop Around: You’ll want to compare prices and services from different insurance companies. Look for good offers and consider things like customer service and online ratings. Also, note that many insurers offer discounts for things like safe driving or driver education courses. Read more on saving on car insurance.

Having an insurance expert guide you saves time

Researching and applying for your own car insurance policy can be time-consuming, but Guided Solutions can simplify the process for you. Here’s how it works:

- Instead of spending hours researching and comparing insurance policies, let Guided Solutions do the work for you. Simply fill out our online quote form, providing some basic details about yourself and your vehicle.

- Guided Solutions will compare quotes from top-rated insurance providers and present you with the most suitable policies based on your needs.

- Once you’ve selected a policy, Guided Solutions will finalize the paperwork and help you secure your coverage.

If you’re ready to make the switch to your own car insurance policy right now, get started by filling out our online quote form.

What are the risks of driving without insurance?

If you’re wondering, “Can I drive my parents’ car without insurance?” you should know that car insurance is mainly for the car, not specifically for the person driving it. So, if you drive your parents’ car with their permission, their insurance usually already covers you.

Again, it all depends on the insurance company’s rules and regulations. Some policies may limit how frequently a car can be borrowed. For example, you might be allowed to drive your parents’ car up to 12 times a year without being listed on their policy. But if you plan to drive their car regularly, it’s best to get added to their insurance. This way, you’ll always be protected in the event of an accident.

Insurance requirements vary by state

You should note that if you are a licensed driver and have your own car, you’ll need some degree of auto insurance — and there are many types of car insurance to consider. As of 2024, New Hampshire and Virginia are the only two states that don’t require car insurance. However, liability coverage is required as a minimum for these two states.

What happens if I drive uninsured?

Driving without insurance can lead to serious legal and financial penalties.

If you’re caught driving uninsured, you could face fines, suspension of your registration and driver’s license, and even legal action.

Additionally, if you’re uninsured and are involved in an accident, you could be looking at tens of thousands of dollars to repair or replace your car and even more if you’re deemed personally liable for damages and medical expenses. It’s a lot less expensive to simply have a decent insurance policy and drive carefully.

Are there alternatives to driving uninsured?

If you’re driving your parents’ car but aren’t covered under their insurance policy, there are alternatives to driving uninsured:

- Temporary Insurance: Car insurance providers don’t offer “temporary insurance policies” to get you through a short visit or a few weeks. Most providers focus on annual policies, although some will insure a licensed driver for a six-month period.

- Start and Stop Policies: A hack to temporary insurance is to start an insurance policy and then cancel when it’s no longer needed. Many companies allow you to cancel a policy without a fee. However, this is not a great habit to get into as it may stay on your record and make it harder to get long-term car insurance when you’re in the market down the line.

- Being Added to Parents’ Policy Temporarily: Let’s say you need to borrow your parents’ car temporarily while yours is undergoing repairs. Your parents may be able to add you to their car insurance policy temporarily. However, our advice is that you don’t go this route if your driving record isn’t pristine, as it could jack up your parents’ monthly premiums considerably.

Can I insure a car that’s not in my name?

If you’re considering insuring a car that’s not in your name, it’s important to understand the process and requirements involved. Check out our recent article on this topic, which provides a detailed overview of why you might want to carry insurance on a car that’s not in your name (and what limitations exist).

Can I transfer ownership of the car to get it insured?

Have a car in your name but don’t have it insured? Consider giving (or selling) it to your parents so they can insure it. Here’s how to transfer ownership /registration of a car in four simple steps.

- You relinquish ownership of the car by signing the back of the vehicle’s title.

- Your parents would be the “buyer” in this case, even if no money is exchanged. They’ll take the signed title to their local Department of Motor Vehicles (DMV). Depending on the state you live in, a transfer form may be required, which is available at the DMV or can be downloaded from their website. If there was money involved, your DMV may also require a bill of sale or proof of payment.

- If satisfied that everything is in order, the DMV will issue your parents a new vehicle registration and title.

- Your parents then need to contact their insurance company to add their new vehicle to their policy, with you as a permitted driver.

Guided Solutions (and your parents) can help!

We hope we’ve answered some of your questions on when you should be on your parents’ car insurance policy and when you should explore getting your own auto coverage. Ultimately, it’s best to discuss your situation with your parents and their insurance provider to decide on the best course of action based on your specific circumstances and local regulations.

Let’s recap on the key points:

- Teens and new drivers should stick with their parents’ car insurance — it’s usually cheaper than getting their own.

- Depending on the insurance company policy, you can stay on your parents’ car insurance as long as they allow it and you live with them. This holds true in most cases, even if you move away temporarily for college.

- If you live with your parents and get a car registered in your name, you can ask for their insurance policy to cover your vehicle (some will and some won’t), or you can get a policy of your own. If you get a policy of your own, you may be asked for the names of all the drivers in your household.

- Once you change your permanent residence and buy your own car, you won’t be able to stay on your parents’ car insurance.

- Driving uninsured carries serious legal and financial risks, so don’t do it.

- Alternatives such as temporary insurance or being added to your parents’ policy temporarily can help bridge the gap until you secure your own coverage.

Still have questions?

Guided Solutions is here to help you every step of the way. Whether you need assistance finding the right policy, understanding coverage options, or applying for your own insurance, our advisors are ready to provide personalized support.

Fill out our online application form here to get started. Or, if you prefer to speak with one of our auto insurance experts, call us at (833) 791-4719, and we’ll answer your questions and guide you through the process.