It may seem counterintuitive, but there are situations in which a licensed driver can insure a car they don’t own — at least partially!

While it’s not always straightforward, non-owner car insurance is a real thing, with some conditions and limitations to consider.

Just remember that it’s important to communicate openly and honestly with your insurance company to ensure you’re complying with their requirements and policies. Misrepresenting information or attempting to insure a vehicle without proper authorization could lead to complications or even legal issues.

That said, let’s explore the specifics of insuring a car that you don’t actually own!

Insuring a car that’s not in your name

There are plenty of scenarios where a licensed driver might want to insure a car that’s not theirs. Here are some specific situations and considerations where being covered on another’s insurance policy — or getting insurance for driving a car you don’t own — is possible:

- You’re a family member: Insurance companies often allow family members living in the same household to put a vehicle owned by another family member on their car insurance policy. This could include parents insuring cars for their children or spouses insuring each other’s vehicles.

- You’re a domestic partner: Similar to family members, domestic partners may be able to put each other’s vehicles on their auto insurance policy — if they share a residence and have a financial interest in each other’s property.

- You’re a co-signer or co-owner: If you co-signed a loan for the vehicle or are listed as a co-owner on the title, you likely have the right to insure the car, even if it’s not primarily in your possession.

- You share ownership: In cases where multiple individuals jointly own a vehicle, any of the owners may have the right to insure it, provided they have the consent of the other owners.

- You’re a permitted user: Some insurance policies extend coverage to drivers who have been granted permission to use the vehicle, even if they’re not the registered owner. This can include a friend borrowing a car for an extended period or rental situations where someone is authorized to drive the vehicle. This isn’t the same as the driver taking out a policy on the car they don’t own, but they can be insured while driving it.

- You’re using it for your job: If the vehicle is owned by a business entity, employees who are authorized to use company vehicles can be insured while driving them under certain circumstances.

Introducing non-owner car insurance

So, let’s explore non-owner car insurance. Also called named-operator insurance, is great for people who frequently rent cars, borrow vehicles, drive company cars, regularly use a friend’s car, or use car-sharing services and want to make sure they have liability coverage while driving. In essence, these policies provide some coverage to you as a driver without insuring a car.

Here’s what non-owner car insurance does — and does not — include:

- Includes Liability Coverage: Non-owner car insurance typically provides liability coverage for bodily injury and property damage liability. This means it covers the costs if you’re at fault in an accident and someone else is injured or their property is damaged.

- Often Acts As Secondary Liability Coverage: Non-owner car insurance often acts as secondary liability coverage. This means it kicks in after the vehicle owner’s primary insurance policy has been exhausted.

- Does Not Include Vehicle Coverage: Non-owner car insurance does not provide coverage for the car you’re driving. It only covers your liability as a driver.

- May Include Additional Coverage: While these policies focus on liability coverage, they may also provide you with medical payments, personal injury protection (PIP), and uninsured and underinsured motorist coverage.

Let’s define “car ownership”

When it comes to getting auto insurance, it’s really important that you know the difference between car ownership and car registration — and the distinction between the legal owner and the policyholder. The following section should help you grasp these concepts a little better.

1. Car Ownership Vs. Registration

Car ownership and registration are like two sides of the same coin: you think they mean the same — and they are interconnected — but they are slightly different.

- Ownership: This refers to the legal ownership of the vehicle, which is typically indicated on the vehicle’s title or registration documents. The owner has certain rights and responsibilities regarding the vehicle, including the ability to buy, sell, or transfer ownership.

- Registration: Registration is the process of officially recording the vehicle with the Department of Motor Vehicles (DMV). It involves getting license plates and the registration certificate, which serves as proof that the vehicle meets the local safety and emissions standards and has valid insurance coverage.

2. Legal Owner Vs. Policyholder

It’s also important to differentiate between the legal owner and the insurance policyholder.

- Legal Owner: Also known as the registered owner, this is the individual or entity whose name appears on the vehicle’s title and/or registration documents. The legal owner holds ownership rights and may have financial or legal obligations associated with the vehicle.

- Policyholder: The policyholder is the individual who purchases an insurance policy to provide coverage for the vehicle. While the policyholder is often the same as the legal owner, this is not always the case. For example, a parent may be the legal owner of a vehicle registered in their name, but they may have purchased an insurance policy for a teenage son or daughter who frequently drives the car. The child would be the policyholder.

3. Importance of Insurance Application Accuracy

There are several reasons to get the details right when listing the registered owner and policyholder on your insurance policy.

- Legal Compliance: Accurate owner and policyholder information helps ensure that the car insurance documents are in legal and regulatory compliance.

- Planned Coverage: Properly listing the registered owner and policyholder ensures that the policy provides the intended coverage for the car and its drivers. It also helps avoid any coverage gaps or disputes in the event of an accident or other insurance claim.

- Claims Process: Insurance application accuracy also helps make handling claims — from processing to resolution to payment — easier and faster.

How can I insure a car that is not in my name?

Getting liability insurance for operating a car that’s not in your name may require some extra steps and consideration, but it’s entirely doable with the right approach.

By contacting insurance providers, providing the necessary information, evaluating quotes, and completing the application process, you can get the coverage you need to drive legally and responsibly, even if you’re not the car’s registered owner.

Let’s break down the steps involved:

Step 1. Contacting Insurance Providers

First, reach out to insurance providers to check out your coverage options. You can do this online, by phone, or by visiting local agents. Just ask about policies for insuring a car you don’t own.

This step is where Guided Solutions can be a real game-changer. You can skip hours of research and comparison shopping by letting us do the work for you. We’ll ask you a few questions — all done online — and after sharing some basic details about yourself and your vehicle, we’ll compare quotes from top-rated providers and present you with the most suitable policies.

Once you’ve made your choice, we’ll take care of the paperwork and help you secure your policy hassle-free. And if you prefer to chat with us instead of applying online, just give us a call at (833) 791-4719.

Step 2. Disclose Relevant Information

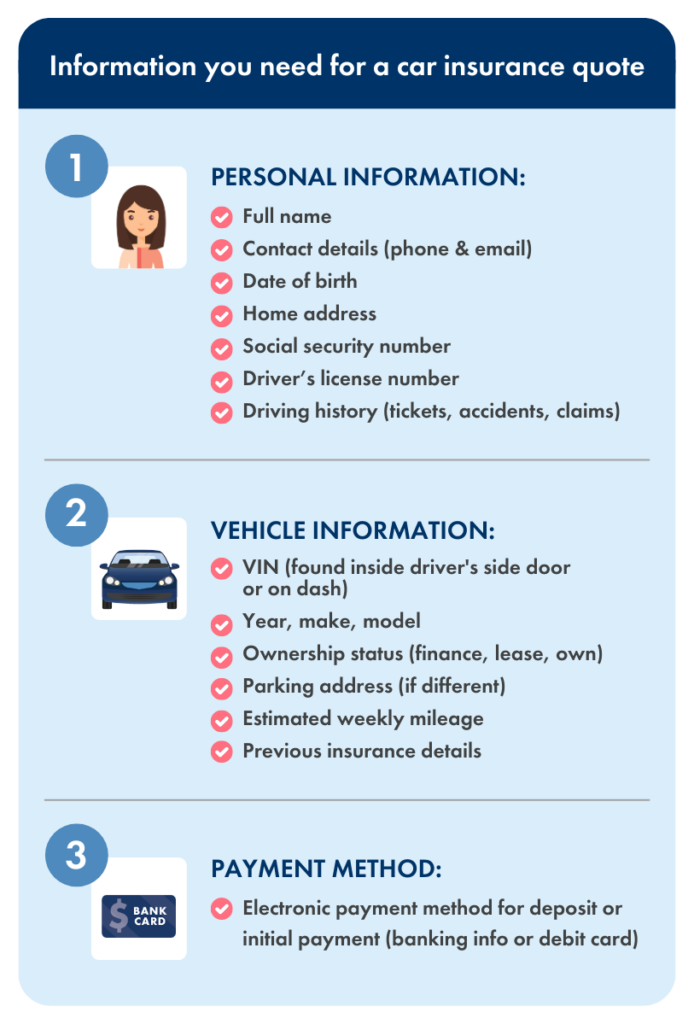

When speaking with us (or other insurance providers if you decide to go that route), be prepared to provide detailed information about the car you wish to insure and its ownership status. This typically includes the car’s make, model, year, and VIN (Vehicle Identification Number), as well as information about the registered owner.

Step 3. Compare Quotes and Coverage

Once you’ve provided the necessary information, insurance providers will offer quotes for coverage options that meet your needs.

If you use our services, a Guided Solutions auto insurance expert will sift through quotes and coverage for you. We’ll then help you compare these quotes, considering things like coverage limits, deductibles, and any additional features or benefits offered by each policy.

Step 4. Completing the Application

After selecting a policy that fits your requirements and budget, you’ll need to complete the insurance application process. This typically involves filling out forms provided by the insurance company and providing any additional documentation or information requested.

Remember, this is where Guided Solutions excels: not only will we find you the best coverage at the best rate, but we’ll also handle all the paperwork to make the process quick and painless.

Step 5: ReviewingYour Policy

Once your application is approved, the insurance company will issue your policy, and you’ll receive confirmation of coverage. Be sure to review your policy documents carefully to understand the terms, conditions, coverage limits, and payment terms of your insurance policy. Of course, if you have questions or need clarification, you can contact us at any time.

8 more things to know about non-owner car insurance

Check these additional thoughts to make sure you understand the full picture of non-owner car insurance policies and can make an informed decision about moving forward.

- Ownership Consent: To take out a non-owner car insurance policy, you’ll usually need the registered owner’s consent. Insurance companies may require proof of ownership or consent from the owner before issuing a policy.

- Insurable Interest: You must have what’s called an “insurable interest” in the vehicle, meaning proof that you would suffer a financial loss if something were to happen to it. This could be because you drive the car regularly for work, you’ve borrowed it long-term, or you’re financially responsible for it in some way.

- Named Insured vs. Additional Driver: Depending on the insurance company and policy terms, you might be able to insure the car in your name with the actual owner listed as an additional driver. Alternatively, you could be listed as an additional driver on the owner’s policy.

- Verification of Identity: Insurance companies will likely verify your identity and driving history when you apply for insurance, regardless of whether you’re the registered owner of the vehicle.

- Full disclosure: It’s super important to be completely open about who owns the car and how you’ll use it, especially when you’re trying to insure a car that’s not in your name. Giving the insurance company all the right info helps ensure that your policy fits your situation perfectly and prevents any surprises or headaches down the road.

- Variable Cost: Non-owner car insurance is typically cheaper than standard car insurance because it provides less coverage. However, the exact cost can vary depending on factors such as your driving history and location.

- Making a Claim: With non-owner car insurance, coverage and claims after accidents or incidents can work a bit differently. Since these policies cover liability — but not damages to the vehicle itself — the rules for claims can vary, so it’s important to understand your policy. But remember, every policy is different, so it’s smart to read yours carefully and ask questions if needed.

- Challenges and Restrictions. As we pointed out above, insurance companies might require proof of consent from the registered owner before issuing a policy. Additionally, some insurers may have specific limitations for non-owner policies, such as driving record criteria or coverage exclusions. There might be a few more hoops to jump through, but it’ll be worth it in the end.

Ready to apply?

As you’ve read, non-ownership car insurance is an option for licensed drivers who frequently drive but don’t own a car. Unlike standard car insurance, it provides liability coverage only, without coverage for the vehicle itself.

Different situations, like being a family member, domestic partner, co-owner, or permitted user — as well as details on how and why you’re going to use the car — can impact your ability to insure the vehicle.

The online application at Guided Solutions can simplify the process for you. Or, for faster service, you can reach us by phone at (833) 791-4719. We’ll help you find the best coverage at the best rate and make sure you understand the process every step of the way.